New York Art Fairs 2009

The Color of Money

By: Charles Giuliano - Mar 19, 2009

Over the boom of the past decade the many national and international art fairs have been the primary means by which galleries promote their artists to what, for a sustained period of time, appeared to be an every growing client base of eager collectors. It was the norm for many booths to sell out during the gala VIP opening nights in which the best works were snapped up in a feeding frenzy. By the time the fairs opened to the general public most of the dealers had made their nut. Considering the expense of renting a booth, upwards of $20, 000 depending on the prestige of the "juried" fairs, and other costs for travel, staff, and installation, this amounts to a significant investment.

For gallerists the primary incentive of the art fairs is the critical mass of traffic. To the smaller, regional and emerging galleries it represents the opportunity to establish reputations and to expand a client base. In many instances the location of a gallery may be where it does day to day business or answers e mail. The local or walk in traffic represents a lesser portion of overall sales. The real outreach and growth for many dealers has been conducted during a network of art fairs.

In the past decade the New York art fairs have gradually increased in visibility and importance. They started modestly as hotel shows like the now famous and seminal Gramercy Hotel show which launched what evolved as Pulse one of the major fairs. As it grew in importance, and became more difficult to qualify for, other hotel shows emerged. The hotel strategy is cost effective as dealers set up their wares in rooms with relatively modest overhead. In some cases, to cut corners, the dealers also bunked down in their "booths".

Significantly, in the mix of art fairs this year there were no hotel shows. Again, the major event was the Armory Show occupying a vast pier on the Hudson River was expanded to have a second, adjoining "Modern" show to complement its "Contemporary" booths. This is the most prestigious of the juried shows attracting the top tier of galleries. In that sense, there is a more established and conservative sensibility. One does not anticipate a lot of risk taking for the The Armory Show. Its organization has acquired Pulse which also had grown to occupy a pier on the waterfront. In general, Pulse is more adventurous and perhaps more satisfying than the mainstream Armory Show. The next tier of better and more established fairs were Scope and Volta. Bringing up the rear were the dreadful wannabes Fountain and Bridge.

Trudging around the art fairs proved to be insightful, for the most part, but exhausting. On Friday and Saturday I logged flat out eight and ten hour days. It was tough on the legs which left me hobbled with a throbbing Achilles tendon and stiff shins. Astrid was in DC visiting the grandchildren so there was nothing to hold me back but fear itself. It helped that there were shuttle vans to connect art fairs. And staying at the Leo House, a favorite of artists on a budget, put me within a relatively short walk to the Chelsea art galleries and several of the art fairs. The good news is that as the week progressed my physical condition and stamina spiked. Art Fairs are an equivalent to spring training. A chance to dust off the cabin fever cobwebs.

The major art fairs cluster around Art Basel Miami in early December. So far we have not made it. But many of the same dealers are on view in New York. The logistics are more convenient and affordable. This also underscores part of the problem. With so many art fairs there is the issue of redundancy. Those who make the effort to get to Miami, for instance, may opt to pass up on New York or Chicago. Some years ago Chicago staged the dominant art fair but that has now been eclipsed by New York and Miami. Of course, the mega fair remains Art Basel but that seems to be now scaling back as dealers, collectors, curators and artists who make these pilgrimages are facing tougher decisions. Arguably, that strengthens the hand of the New York art fairs as this is where the greatest critical mass of galleries and collectors are located. During our tour of Chelsea galleries we found many of the international dealers making the rounds.

Of course, the critique of the art world and the phenomenon of the art fairs is that they have been driven by the greed of all that new money. The art market soared with the economic boom that saw the Dow peak at over 14,000 before it hit historic lows, a couple of weeks ago, around 6,500. There has been a modest rally to around 7,500 this past week but even the most optimistic feel that it will be a couple of years before the Dow again cracks 10,000.

Who knew a year ago that the economy would tank so hard and so fast? Dealers participating in the major art fairs had to make commitments last August. One dealer we talked with, who has since closed their Chelsea gallery after months of not making significant sales, told us last fall of difficulty in backing out of Scope. Ironically, he had been one of the founders of Scope. He and his partner have decided to pull back and wait to take advantage of the cheaper Chelsea real estate as many leases expire and are not renewed. The idea is to conserve resources and wait for an improvement in the economy. They were threatened with a lawsuit for wanting to cancel but another dealer emerged to take their space. One hears versions of this strategy all over Chelsea. As well as, lively rumors as to who will or will not be left standing at the end of a very rough season.

Some of the artists and critics we talk with, however, see the financial tsunami as a cloud with a silver lining. It is an opportunity to expose the crassness and greed of the current art world that has been bloated by heightened expectations and bumper crops of newly minted MFAs and their often insignificant work. The mostly mediocre work by emerging artists was propped up by a boom in the art market. Aesthetic debates mean little in the face of work that sells. The red dot next to a work is its bona fide of quality. Of course, as sales are slowed to a trickle, particularly for emerging artists, there is more incentive for aesthetic argument.

As hard pressed collectors, many of whom made easy money in the boom, now have to dump work onto the secondary money to raise cash of mounting debt, just what is the work they paid top dollar for worth in a tanking market? Just as in the busted real estate market many individuals were conned into "investing" in art as collateral they could "flip" during an escalating market. These speculators/ collectors are now stuck with holdings that are more or less worthless. This is an old story in the boom and bust art world. It once again underscores the wisdom that one should only acquire works of art that you plan to live with. Works that we love will always hold their value.

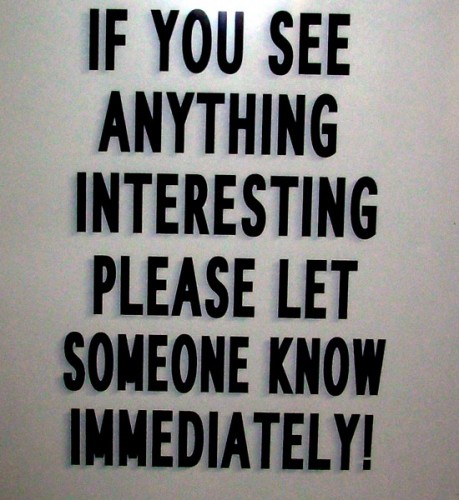

So a bit of "correction" is viewed as not such a bad thing if it proves to drive the money lenders out of the temple of art. Which is, indeed, a romantic and foolish notion. Just who are the high priests speaking to the purity of the temple of art which has always been driven by talent, greed, and opportunity? In that sense I do not intend to adopt the role of Simon of the Desert or to strut around Chelsea wearing a sandwich board that proclaims

"Repent Ye Sinners." Perhaps a better slogan for these hard times is "Caveat Emptor."

Which is more or in the mood we observed in Chelsea Galleries and the Art Fairs. Those with the most durable goods, the rarest and most prized items, were still making sales. While traffic was generally off from this time last year the reports from fair organizers were more sanguine than had been anticipated. There were, of course, dealers from Tokyo, Vienna, Berlin, Madrid, London and Paris who returned home with few or any sales. Come next August one wonders how many will be signing on to return in 2010? While the Art Fairs this year were running on vapors by next year they may be out of gas.

It was with some macabre curiosity that we toured the galleries and fairs looking for the prominent signifiers of the last gasp of the Ancien Regime as we have known it. In some ways the diminished traffic made for a more enjoyable experience. There was sufficient breathing room to really interact with the work.

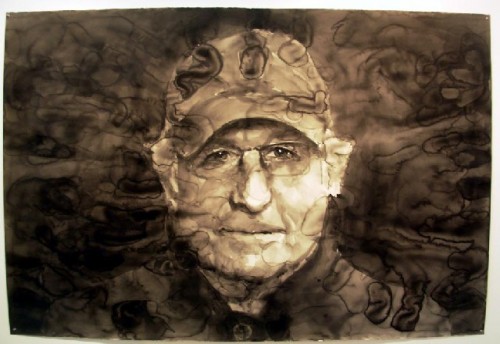

The single image that everyone latched onto as a sign of the times was a large water color portrait of swindler Bernard Madoff by a Chinese artist. It drew a lot of attention in the booth of New York dealer David Zwirner in the Armory Show. But, at $100,000, there were no takers. I was surprised that the work was not vandalized. Considering how much the con artist is despised it is remarkable that the gallery did not display the work behind bullet proof glass. If someone were seriously interested, however, the Madoff piece might have been had for $50,000. It is the norm for galleries to offer 10 and 15% discounts to their best clients but there was talk of much deeper discounts by dealers desperate to recover costs. There were sales but at what prices?

In the bottom feeding art market the fewer buyers with dry powder were looking for value and price. There were many wonderful and attractive works being offered for those who can afford them,

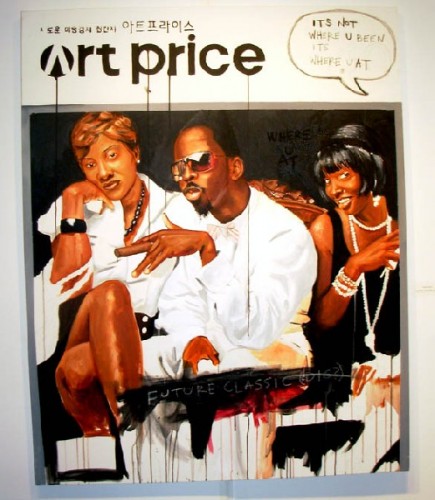

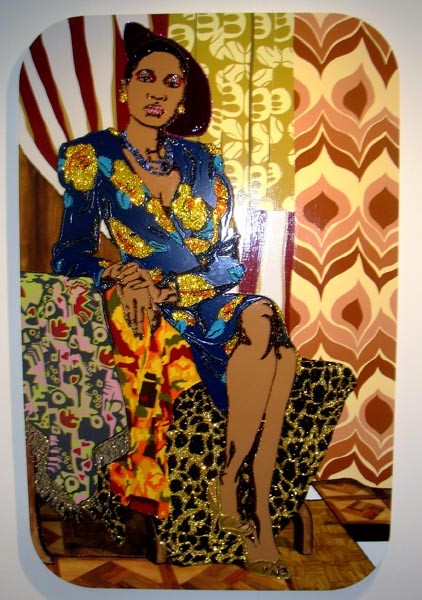

In addition to the Madoff portrait there were other amusing and timely signifiers of greed. We spotted a sculpture representing a Golden Calf. How's that for a metaphor? There were quite a number of examples of glitter and gold. As well as the art school wisdom that the key to success is to create works that are Big, Red, and Shiny. There were lots of examples of this strategy.

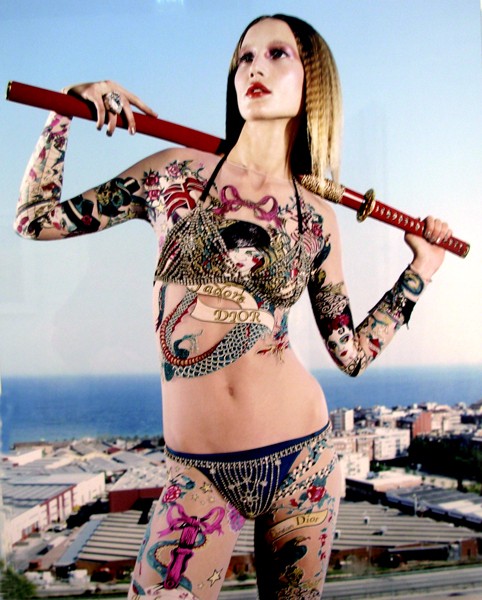

Although now a bit out of date the most hilarious example of greed and excess was a series of five photographs of that wild and crazy lady, Imelda Marcos, by Steve Tirona in the Philippines based Silverlens Gallery. The images are so outrageous that I assumed that they were spoofs created with Photoshop. I was surprised to learn that they were actually commissioned by Mrs. Marcos. The series was being offered at $10, 000 for the five prints in an edition of 15. The gallery had sold a couple of sets.

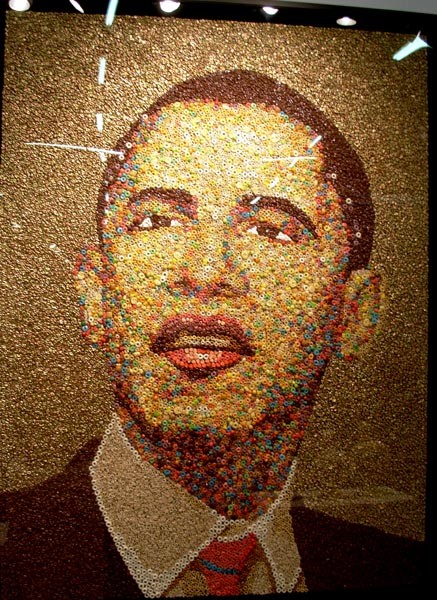

By the end of the busy weekend I was pretty wiped out. That's a lot of slogging around. But it was definitely worth the effort. Jack Shainman's booth in the Armory Show was once again a joy and inspiration. There were several of the stunning hanging tapestries by the African artist El Anatsui. As well as the wonderfully fresh and inventive new tribal, fetish figures of Nick Cave. Definitely Shainman had the best booth. Which proves that if you are patient enough you will find what you are looking for. Although you can't always get what you want, if you try sometimes, you'll get what you need.